There are trading practices and processes that greatly contribute to the degree of profitable trading and greatly determine the success of traders, especially when done methodically and correctly. One has to master this processes concurrently to trade effectively and profitably, and this is where most traders fall short and we will demonstrate how the EA will try to navigate and solve this challenge.

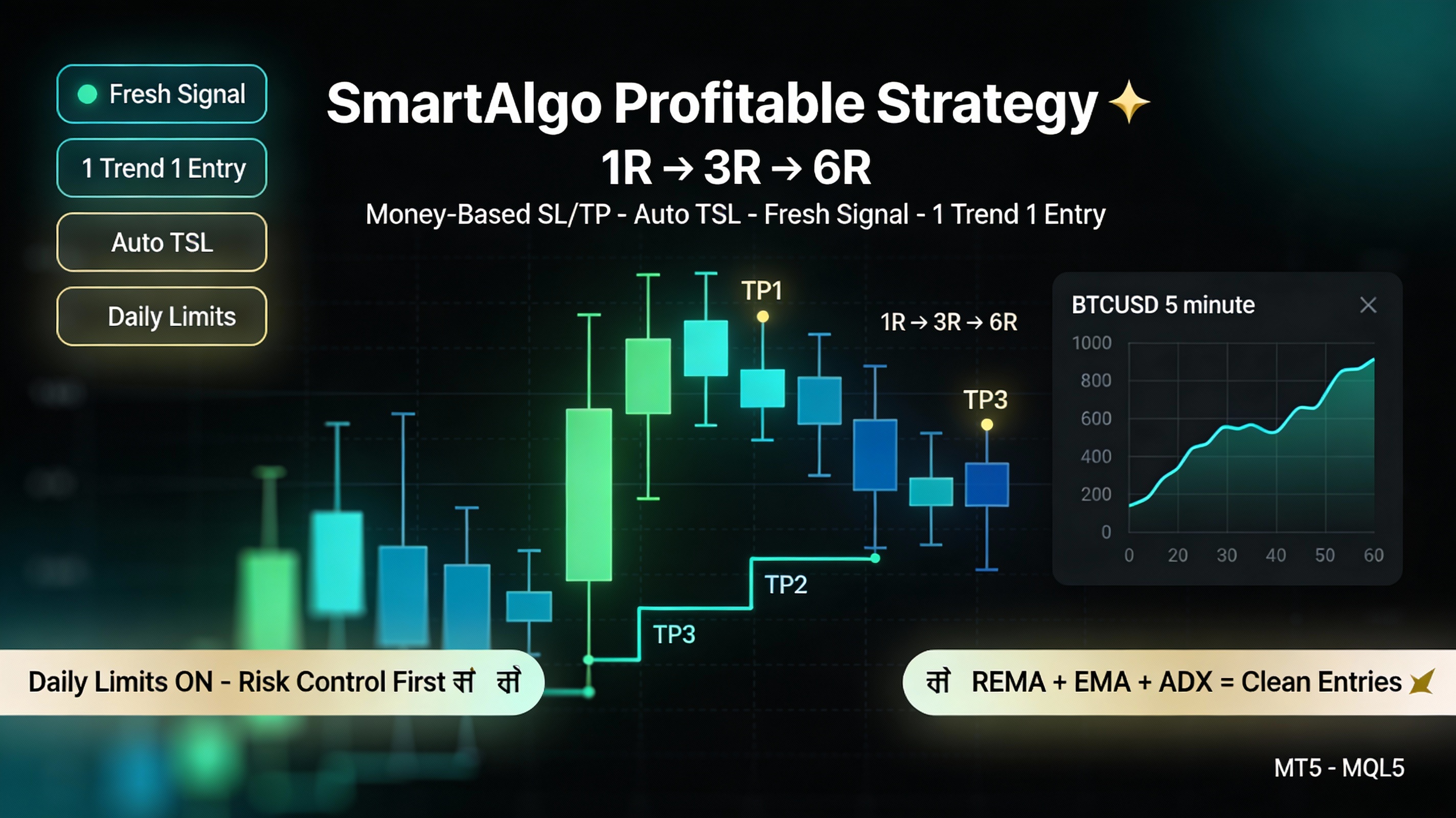

Below I will briefly explain how the Expert Advisor will aim to address and accomplish the challenges traders face while automating this process. These processes and practices are namely

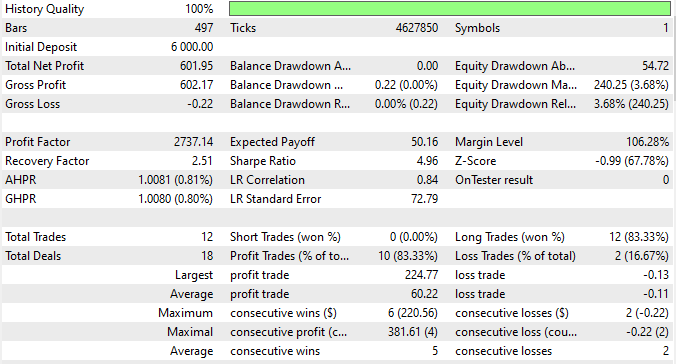

Proper risk management: the Expert Advisor in this article is designed to ensure it implements very solid risk and trade management to ensure all prop firm rules are respected and not breached. This is the most important practice and process since one can no longer trade without capital or a breached account.

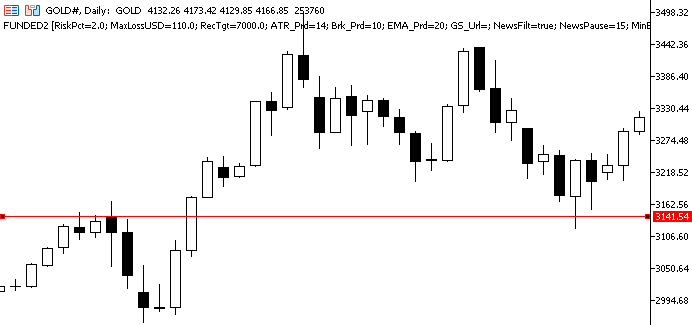

Trading plan: The Expert Advisor has an automated and strict logic flow for trading that will only allow trading when desired market conditions are met and will not execute trades due to emotions or anxiety.

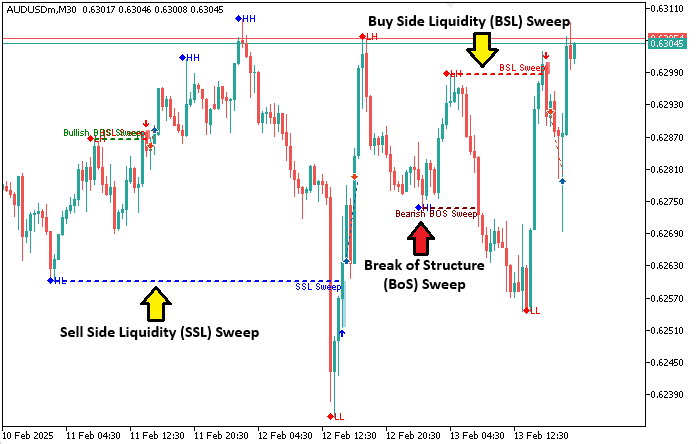

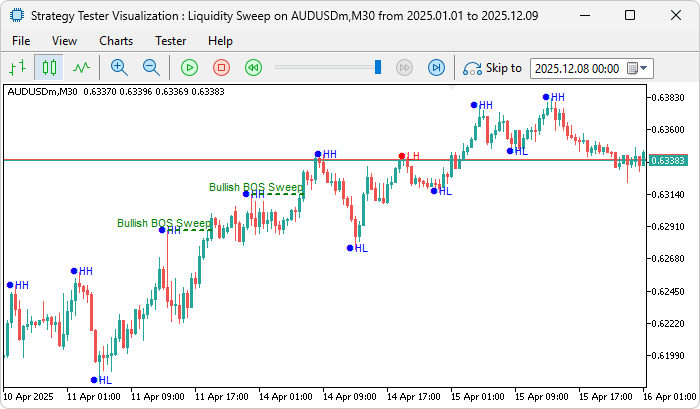

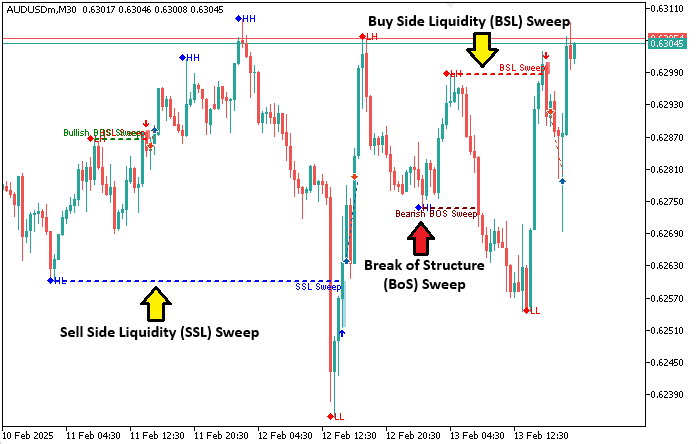

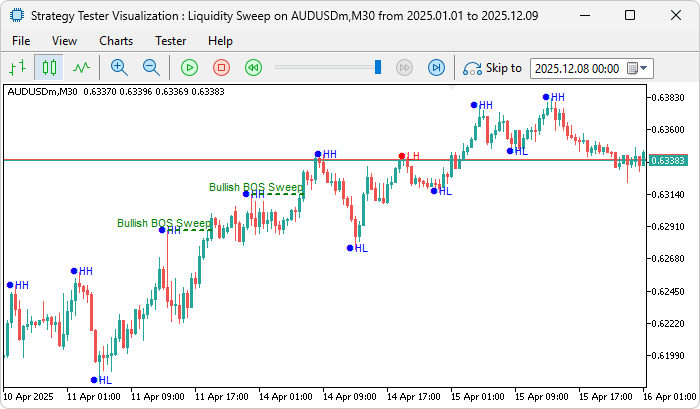

Market analysis: The Expert Advisor analyzes the market in a particular order and logic that ensures it avoids errors and minimizes human error/bias during market analysis and trading. Top-down analysis ensures it avoids strategy hopping, common in manual traders when frustrated with poor results.

Excellent trading psychology: With the automation of this Expert Advisor, we can eliminate revenge trading after loss, impulsive trading caused by fear and greed, and FOMO (fear of missing out), ensuring patience and discipline, which are crucial for long-term success in prop firm trading, are respected.

The thing is a trader not only has to fully understand one process and practice, but he or she must fully grasp and understand all the trading processes and grasp them by the palms of his hands because mastering one process without the others or mastering a few and omitting one or two will quickly result in his undoing since he will still lack essentials to navigate the market efficiently and profitably over a long period, and any initial success will be short-lived.

The automation of this trading processes helps alleviate the pressure from the traders since the core logic of the EA ensures it performs all the processes and practices, not even missing one step to ensure it has considered all the variables before executing, as opposed to a manual trader who may get carried away by emotions, anxiety, or even fear and fail to do a basic task, which may lead to losing trades.

To be successful in this field, one has to master all the elements that are involved in trading and learn to combine them and use them at one go, not omitting even one of the elements. In this article, as we have already discussed why and how most traders do not qualify for funded accounts because of poor risk management, we will now elaborate on the inner workings, design, and function of how this EA implements the trading logic and risk management protocol to achieve our targets.